Changes to National Minimum Wage rate from 1 April 2024

The National Minimum Wage came into effect with the implementation of the National Minimum Wage Act 1998, with the aim of reducing ‘poverty pay’ and the income gap between the low-paid and other workers.

What is the National Minimum Wage?

The National Minimum Wage is the minimum pay workers are entitled to receive per hour.

What do I need to do?

As an employer, you must be aware of the NMW rates and ensure you are paying your employees according to their age and employment status. This may also require you to review the salary rates for those on salaried contracts.

This year sees the government make the largest ever cash increase to the minimum wage. This increase comes partly as a reaction to the current cost-of-living crisis, which has seen inflation peak at 11.1% – the highest in 40 years.

What are the new National Minimum Wage rates of pay?

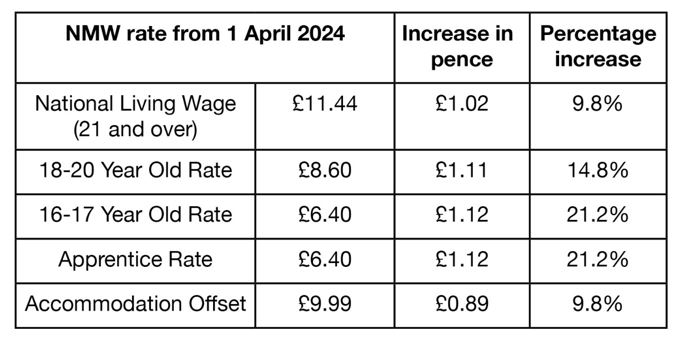

The rates recommended by the Low Pay Commission are set out below.

What happens if I don’t pay the National Minimum Wage?

If you, as an employer, fail to pay the national minimum wage then the employee has two options available to them; they can choose either to complain to HMRC or to make a claim via an employment tribunal. They cannot take the same issue through both legal processes.

How does the complaints process work?

If the employee chooses to make a complaint directly to HMRC, they will then start an investigation.

If HMRC finds that the employer has not paid the minimum wage, they can take the following action against the employer:

- issue a notice to pay money owed, going back a maximum of 6 years

- issue a fine of up to £20,000 and a minimum of £100 for each employee or worker affected, even if the underpayment is worth less

- take legal action, including criminal legal proceedings

- pass on the names of businesses and employers to the Department for Business and Trade (DBT) who may put them on a public list

What if the employee makes a claim to an employment tribunal?

The amount of money the employee or worker can claim will depend on the type of claim they make. For example, if they make a claim for non-payment of minimum wage, they can claim for money owed going back 2 years.

An employee can claim up to 2 years back pay, as long as either of the following criteria apply:

- there is less than 3 months between deductions

- the deductions are linked – for example, they might be linked if they are caused by the same error

About the author

This article is provided by our sister company, Stallard Kane, a specialist risk management service provider offering expert advice and solutions in Health and Safety, HR, Risk Solutions and Training. This article is for general guidance only and aims to provide general information on a relevant topic in a concise form. This article should not be regarded as advice in relation to a particular circumstance. Action should not be taken without obtaining specific advice.

If you want a truly personalised service, contact your usual Towergate advisor today who can put you in touch with Stallard Kane’s HR Team to discuss your requirements – call 01427 420 403 or email hr@skaltd.co.uk, and #oneoftheteam will be happy to help.

Date: May 10, 2024

Category: Small Business